The intersection of AI, blockchain, and virtual reality marks a significant leap toward a unified digital future, especially as we enter 2024. The convergence of these technologies is not just about blending different digital realms but creating a harmonized platform that expands our digital experiences. This synergy is particularly evident in the growing domain of AI coins, which are set to redefine the landscape of blockchain technology and cryptocurrency investments in 2024.

The Rise of AI Coins

AI coins are emerging as the best AI coins in 2024, riding on the wave of technological advancements and market demands. These digital assets represent the forefront of the crypto market's evolution, merging the capabilities of artificial intelligence with blockchain technology's decentralized, secure nature. The fusion of AI and blockchain opens new avenues for efficiency, security, and innovation in digital transactions and services.

Market Dynamics and AI Integration

As we navigate through 2024, the market is witnessing a significant surge in the adoption of AI coins, underscoring their potential as the top AI coins of the year. This trend is driven by the increasing recognition of AI's role in enhancing blockchain functionalities, from improving transaction security to enabling more complex, autonomous economic agents. The unique attributes of AI coins, including their ability to facilitate secure, transparent transactions and to leverage AI for smarter, more adaptive networks, position them as key players in the future of cryptocurrency.

Technological Convergence and Digital Transformation

The seamless integration of AI, blockchain, and virtual worlds is set to redefine our digital interactions. AI's role in this convergence is particularly transformative, enabling the creation of more immersive, responsive virtual environments. In the context of AI coins, this means the potential for more intuitive, user-friendly platforms that can adapt to and predict user needs and market changes, making them some of the best AI coins for investors in 2024.

Future Outlook and Investment Potential

Looking ahead, the best AI coins in 2024 are expected to lead the charge in the next wave of digital innovation, with their underlying technologies paving the way for a more integrated, efficient, and secure digital ecosystem. Investors and enthusiasts watching the rise of the top AI coins will likely witness an exciting period of growth and innovation, making these digital assets a potentially lucrative addition to their investment portfolios.

In conclusion, the future of AI and cryptocurrency is bright, with AI coins standing out as the shining beacons of progress and potential in 2024. Their evolving role in the digital economy highlights the importance of staying informed and engaged with this dynamic sector's latest trends and developments.

NEAR Protocol: Pioneering a New Era of Scalable AI Solutions

NEAR Protocol emerges as a distinctive player in the blockchain arena, primarily focusing on enhancing user experience within the Web3 ecosystem. It is a Layer 1 blockchain network designed to simplify the interaction with Web3 products like crypto exchanges, NFT galleries, and social networks. NEAR Protocol is a bridge that enables a seamless connection between different blockchain platforms while fostering a unified user experience.

Unique Features of NEAR Protocol

NEAR Protocol sets itself apart with several unique features. It boasts true carbon neutrality, superior transaction speed with finality within one second, and high throughput capable of handling up to 100,000 transactions per second. Additionally, it maintains low transaction fees to encourage broader usage and supports interoperability through various cross-chain solutions like Aurora EVM and Octopus Network. NEAR also provides a nurturing environment for developers, offering extensive funding opportunities and simplifying user interactions with human-readable account names.

Technical Analysis and Future Outlook

NEAR employs a novel sharding design, Nightshade, to achieve mass scaling by processing transactions in parallel across multiple shards. This approach, combined with a sharded proof-of-stake consensus, helps maintain the network's speed, security, and efficiency. The protocol plans to increase its validator pool to enhance decentralization and network robustness. A significant portion of NEAR tokens is staked, reflecting strong community trust and involvement.

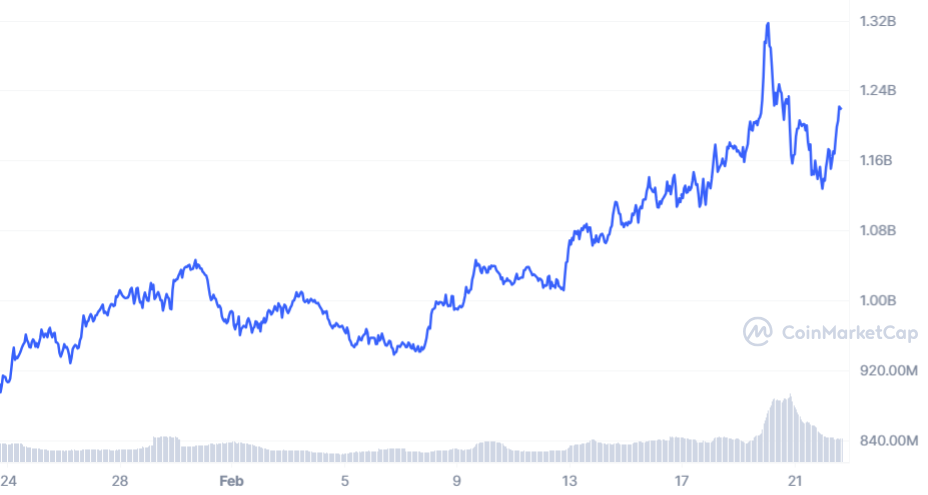

NEAR Protocol's Market Dynamics and Future Predictions

Despite the market's bearish sentiment, NEAR Protocol shows signs of a bullish future. The protocol has actively engaged with the community, offering support and funding through initiatives like Build V3, which provides "no-strings-attached grants" to developers. This involvement indicates a commitment to continuous growth and innovation. Price predictions for the NEAR Protocol are optimistic, with expectations of significant value increases over the next decade. Analysts forecast a progressive rise in NEAR's price, predicting substantial growth by 2033.

THETA Network: Revolutionizing Video Streaming with AI

THETA Network is designed as a next-generation platform focusing on media, AI, and entertainment. It aims to revolutionize the existing video and media platforms by reducing content delivery costs and rewarding users for sharing their resources, such as storage and bandwidth. THETA is compatible with Ethereum, enabling various Web3 applications, including NFTs, decentralized exchanges (DEX/DeFi), and decentralized autonomous organizations (DAOs). Global leaders like Google and Sony oversee its governance, and it has partnerships with major content providers like Lionsgate and NASA. The network comprises the Theta Blockchain for payments and smart contracts and the Theta Edge Network for media storage and delivery.

Technical Aspects and Innovations

The Theta Blockchain is unique with its multi-level BFT consensus mechanism, combining Enterprise Validator Nodes with community-run Guardian Nodes, ensuring high security and decentralization. It supports smart contracts and is EVM-compatible, allowing various applications from video streaming to interactive media experiences. The network is set to expand with the Theta Metachain, which is aimed at infinitely scalable transactional throughput and faster block finalization times.

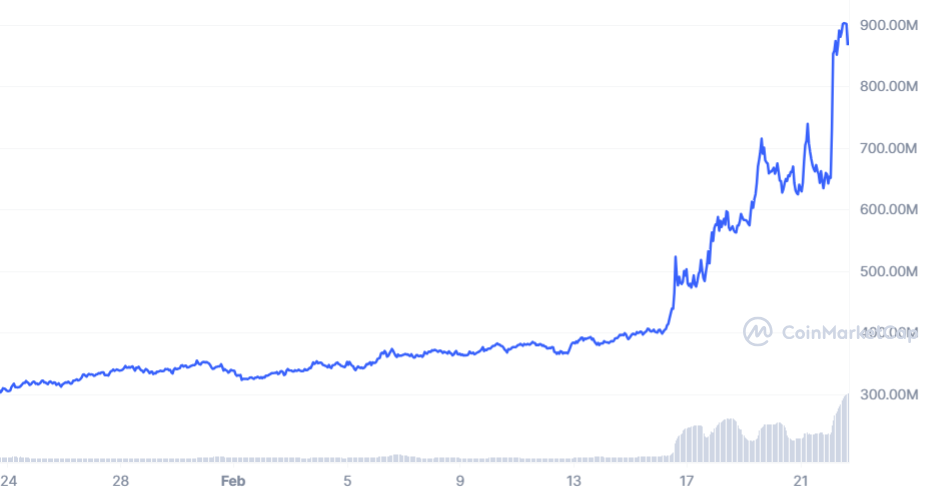

Market Analysis and Future Predictions

The price predictions for THETA in 2024 show a steady increase throughout the year, starting with an average rate of $1.16 in February and potentially reaching up to $1.80 in December. This growth reflects a positive outlook from crypto analysts based on THETA's performance in 2023 and its technological advancements. By 2025, the price is expected to range between $2.17 and $2.69, indicating significant growth potential. This uptrend continues into 2026 and beyond, with prices predicted to escalate further, showcasing the growing confidence in THETA's market position and its underlying technology.

Render Token (RNDR): Democratizing GPU Rendering with Blockchain

Render Token (RNDR) is revolutionizing the digital and AI content creation industry by offering a distributed GPU rendering network. Built on the Ethereum blockchain, RNDR aims to connect artists and studios requiring GPU compute power with GPU owners willing to rent out their resources. This innovative approach democratizes rendering and offers a sustainable model for artists and GPU providers alike.

Migration to Solana and Tokenomic Innovations

Render Network has announced plans to migrate its infrastructure to Solana to enhance scalability and stability. This transition includes introducing a new tokenomic model, the burn-and-mint equilibrium (BME), alongside a new SPL token, RENDER. While the original ERC-20 RNDR token will remain active until a transitional period ends, it will eventually become unusable on the Render Network. However, users are incentivized to transition smoothly to the new system without being forced, ensuring a seamless changeover.

Market Analysis and AI Integration

The Render Token has been gaining traction, mainly due to the rising demand for computing power in AI, such as machine learning and large language models. This demand places RNDR among the leading "AI coins," reflecting the growing trend in tech industries towards AI-driven solutions. The integration of Render's services with AI applications showcases its utility and boosts its market value and appeal.

Price Predictions and Future Outlook

Price predictions for RNDR show an optimistic trend. Analysts expect an upward trajectory in the coming years, with potential price increases influenced by technological advancements and market dynamics. For example, by 2024, RNDR's value is expected to fluctuate and potentially increase significantly if certain market conditions and development milestones are met. The Render Token's integration into the AI and digital creation landscapes and its migration to Solana is anticipated to bolster its growth and adoption.

Fetch.ai (FET): Automating the Economy with AI Agents

Fetch.ai is recognized for its innovative approach to decentralized digital economies through autonomous agents powered by artificial intelligence (AI) and machine learning (ML). The platform aims to connect various IoT devices and algorithms to enable collective problem-solving without human intervention. Fetch.ai's mainnet launch in 2020 marked a significant step towards automating online purchases and other repetitive tasks using AI bots.

Market Analysis and Future Projections

Fetch.ai has been identified as a leading AI coin, showing potential for substantial growth due to its unique value proposition in the blockchain and AI sectors. The token has seen varying predictions for its future value. Some analyses suggest a bullish outlook for Fetch.ai, with expectations of price increases in the coming years—predictions for 2025 range from a potential high of around $1.60, indicating significant growth potential. By 2030, Fetch.ai's value could further increase, with estimates suggesting a range between $2.24 and $3.66, showcasing optimism for long-term growth.

Technical Insights and Correlations

Fetch.ai has shown positive correlations with other prominent cryptocurrencies, suggesting that market movements in these coins could influence FET's price direction. The token has shown particular correlation strength with Gnosis, Render Token, and SingularityNET, which could be due to their shared focus on AI and blockchain innovations.

Investment Potential and Sentiment

The current sentiment around Fetch.ai is mainly bullish, reflecting optimistic investor and market attitudes toward the token. This optimism is supported by technical analyses and market indicators suggesting that Fetch.ai is a potentially profitable investment. However, as with all investments, especially in the volatile cryptocurrency market, it's crucial to conduct thorough research and consider various market analyses before making investment decisions.

SingularityNET (AGIX): Bridging AI and Blockchain for a Decentralized AI Economy

Overview of SingularityNET (AGIX)

SingularityNET is a decentralized AI platform aimed at democratizing access to AI technology. It leverages blockchain to provide AI developers and users with a transparent and collaborative environment. By connecting various AI services globally, SingularityNET facilitates the creation, sharing, and monetization of AI services, promoting a more equitable distribution of AI capabilities.

Market Analysis and Future Predictions

The trajectory of AGIX has been marked by volatility, which is common in the crypto market, with significant fluctuations observed in its price history. Despite the downturns, AGIX has shown resilience with recovery periods, mainly influenced by market trends and technological advancements within the AI sector.

Recent performance suggests a burgeoning interest in AI-driven blockchain projects, with AGIX experiencing notable increases in value during specific periods, particularly in line with broader AI market booms. However, the token has also faced downturns, reflecting the overall market's volatility and the impact of broader economic factors on cryptocurrency prices.

Price Predictions for SingularityNET (AGIX)

Based on the information gathered from various sources, the future predictions for SingularityNET (AGIX) show multiple outcomes. The current market trends and technical analyses provide a broad spectrum of potential future prices for AGIX.

For the upcoming years, particularly looking towards 2024, 2025, and beyond, different sources offer different insights:

- CoinCodex suggests that there might be a slight fluctuation in AGIX prices shortly, with potential resistance and support levels indicating a range between higher resistance levels around $0.750 to $0.937 and lower support levels around $0.374 to $0.562. They also project that by 2024, AGIX could trade within a range of $0.584 to $1.061, indicating a significant potential increase from current levels.

- Changelly provides daily price predictions showing that AGIX might experience minor fluctuations. They present a more short-term view, with price changes noted for each day and speculative price ranges for the upcoming years. Their analysis indicates possible declines or slight increases in the near term, reflecting typical market volatility.

- CoinEdition via Investing.com offers a broader outlook, suggesting bullish scenarios where AGIX's price could range from $0.19048 to $2.62. They even propose the possibility of the price reaching above $3.5 in the distant future. This optimistic scenario reflects the potential growth of SingularityNET as it continues to develop its AI services and marketplace.

It's important to consider that these predictions are based on current market conditions, historical data, and technical analyses, and they can be subject to change due to external market factors. Additionally, as with all investments, risk is involved, especially in the volatile cryptocurrency market.

For those considering investing in SingularityNET or holding AGIX tokens, staying updated with the latest market trends, news, and technical analyses is crucial. Also, consider diversifying your investment portfolio to mitigate risks. Make investment decisions based on your research, risk tolerance, and financial situation.

Investment Considerations

The decision to invest in SingularityNET should be based on a comprehensive analysis of the platform's potential, the general trend in AI and blockchain integration, personal investment goals, and risk tolerance. Given the volatile nature of the cryptocurrency market, it is advisable to invest cautiously and be prepared for the possibility of price fluctuations.

As with all investments, particularly in the dynamic crypto space, it is crucial to stay informed about market trends, technological advancements, and regulatory changes that could impact the value and utility of AGIX.

Unveiling the Powerhouses: A Side-by-Side Comparison

Our exploration focuses on five prominent AI coins: NEAR, THETA, RNDR, FET, and AGIX. Each boasts distinct offerings, catering to specific needs within the AI landscape. Let's dissect their core functionalities and assess their potential:

1. NEAR: Scaling the Heights of Speed and Efficiency

USP: A high-speed, scalable smart contract platform utilizing sharding technology, promising rapid transactions and low fees.

Strengths:

- Blazing-fast performance: NEAR boasts transaction speeds surpassing traditional blockchains, attracting developers and users seeking efficiency.

- Low transaction fees: Compared to Ethereum, NEAR offers significantly lower fees, making it appealing for cost-conscious users.

- Thriving DeFi ecosystem: A burgeoning Decentralized Finance (DeFi) landscape on NEAR presents diverse investment and utility opportunities.

Potential Risks:

- Technological complexity: while enabling scalability, sharding introduces additional complexities that could pose challenges for novice users.

- Less established: Compared to older platforms like Ethereum, NEAR has a shorter track record, requiring careful evaluation.

Suitability: Growth-oriented investors seeking exposure to a potentially high-performing platform with innovative technology and a promising DeFi ecosystem.

2. THETA: Decentralizing Video Streaming for a Global Audience

USP: A decentralized video streaming network leveraging token staking rewards for secure and efficient video delivery.

Strengths:

- Efficient video delivery: THETA's peer-to-peer network architecture promises faster loading times and improved video quality.

- Strong partnerships: Collaborations with leading tech giants like Samsung and SONY bolster the platform's credibility and potential reach.

- Growing user base: THETA experiences steady user adoption, indicating increasing market interest in decentralized video streaming.

Potential Risks:

- Competition from established players: Major streaming platforms like Netflix and YouTube pose significant competition.

- Regulatory uncertainty: The emerging nature of decentralized video streaming raises regulatory questions that could impact adoption.

Suitability: Investors interested in the future of video streaming and the potential for token appreciation in a rapidly evolving industry.

3. RNDR: Democratizing High-Performance Computing for Creative Professionals

USP: A decentralized GPU rendering platform offering access to high-performance computing power for 3D graphics and VFX creation.

Strengths:

- Cost savings: Compared to traditional cloud rendering services, RNDR promises potential cost savings for creators and studios.

- On-demand access: RNDR facilitates access to high-performance computing resources without upfront investments in costly hardware.

- High demand: The growing metaverse and increasing demand for high-quality visuals create a fertile ground for RNDR's services.

Potential Risks:

- Limited adoption: While promising, RNDR needs wider adoption by creators and studios for mainstream success.

- Competition from established cloud rendering services: Existing players like AWS and Azure pose stiff competition.

Suitability: Investors seeking exposure to the metaverse and the potential growth of a decentralized rendering platform catering to high-demand computational needs.

4. FET (Continued): Unclear Token Utility and the Long Road Ahead

While FET possesses exciting potential, the project's early stage necessitates careful consideration. The unclear long-term utility of the FET token adds further complexity to investment decisions. While it currently serves as a transaction medium within the platform, its future role requires transparency from the development team.

Suitability: High-risk, high-reward investors who believe in the transformative potential of autonomous agents and are comfortable with early-stage projects and potentially volatile token values.

5. AGIX: Building a Decentralized Marketplace for AI Solutions

USP: A decentralized marketplace for AI services and tools to democratize access, foster collaboration, and empower participants.

Strengths:

- Democratizing AI: AGIX removes barriers to entry, allowing anyone to access and contribute to the development and utilization of AI tools.

- Fostering collaboration: The platform promotes collaborative efforts, potentially accelerating AI innovation and knowledge sharing.

- Growing community: A passionate community of developers and users strengthens the platform's potential for long-term sustainability.

Potential Risks:

- Competition from centralized platforms: Established AI solution providers pose significant competition.

- Regulatory challenges: AGIX navigates evolving regulatory landscapes that could impact its operations like other decentralized platforms.

Suitability: Investors interested in the potential of decentralized AI solutions and marketplaces believe in the power of community-driven innovation and are willing to navigate potential regulatory hurdles.

Beyond the Binary: A Spectrum of Considerations

Investing in AI coins requires a nuanced approach. Beyond the individual strengths and weaknesses of each project, consider these broader factors:

- Market Capitalization: Analyze the total value of outstanding coins (market cap) to gauge project size and potential growth. Smaller market caps offer a higher potential for rapid price increases and carry greater risk.

- Trading Volume: High trading volume signifies liquidity and potentially more stable prices, making entering and exiting positions easier.

- Team and Community: Research the team's expertise and the project's community engagement to assess its capabilities, direction, and long-term viability.

Remember: Diversification is paramount. Allocate your investments across AI coins based on risk tolerance and investment goals. Cryptocurrency remains

highly volatile, and past performance does not indicate future results. Conduct thorough research before making any investment decisions.

This guide equips you with the knowledge to navigate the ever-evolving landscape of AI coins. By understanding each contender's unique offerings, strengths, and risks, you can make informed investment decisions and chart your course in the thrilling world of AI-powered cryptocurrencies.

Pingback: The Hidden Gem: MYRO COIN 50x Return - techlooters.com