Cryptocurrency trends 2024 are not just about market fluctuations or the next big coin; they are about witnessing a revolution in digital finance. As we edge closer to 2024, the crypto landscape is poised for transformative changes. From the surge in major cryptocurrencies like Bitcoin and Ethereum to the rise of efficient platforms like Solana, the crypto world is gearing up for an exciting future. This article explores the heart of these changes, uncovering predictions and trends that are set to redefine the way we interact with money and technology in 2024 and beyond.

Positive Momentum in Major Cryptocurrencies

In 2023, major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have shown significant growth. Bitcoin, known for being the first and most prominent cryptocurrency, has seen a remarkable surge in its price. It increased by more than 100% year-to-date. This kind of growth indicates strong investor confidence and wider acceptance of Bitcoin in the market.

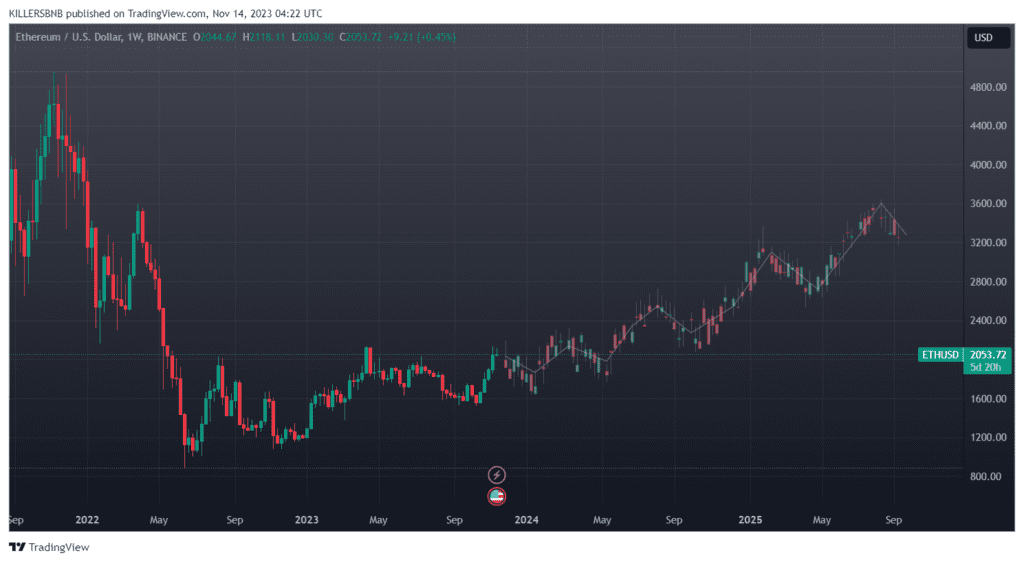

Ethereum, another leading cryptocurrency, also enjoyed growth, with its price going up by nearly 50%. Ethereum is particularly notable for its vibrant ecosystem that supports various blockchain applications, including smart contracts and decentralized apps (dApps). The development and adoption of Ethereum suggest a growing interest in more than just the monetary aspect of cryptocurrencies. It reflects a broader enthusiasm for blockchain technology's potential applications.

These trends in 2023 set a positive backdrop for 2024. The growth in major cryptocurrencies like Bitcoin and Ethereum points to an increasing acceptance of these digital currencies as both investment vehicles and technological innovations. Their performance also influences the broader crypto market, often setting trends that other cryptocurrencies follow.

In simple terms, if the current growth and interest in Bitcoin and Ethereum continue, 2024 could see these cryptocurrencies becoming even more integral in the financial and technological landscapes. This growth is not just about the rise in their prices but also about how they are increasingly being integrated into various digital applications and financial systems

Bitcoin Analysis

Bitcoin, often referred to as digital gold, has shown a remarkable performance in 2023, gaining 67% year-to-date. This growth reflects not just investor interest but also Bitcoin's increasing legitimacy in the financial world. Its resilient nature and widespread recognition have made it a popular choice among investors, especially in times of economic uncertainty or when diversification away from traditional assets is sought.

One of the key factors influencing Bitcoin's value and appeal is its limited supply. With only 21 million Bitcoins ever to be mined, this scarcity adds to its value proposition. Additionally, Bitcoin's decentralized nature, being independent of any central authority, makes it an attractive asset for those looking for alternatives to traditional, centrally-controlled currencies.

Looking forward to 2024, the expectation is that Bitcoin will continue to intertwine its growth with wider acceptance and adoption. Its role as both a store of value and a potential medium of exchange is likely to expand, especially as more institutions and retail investors enter the cryptocurrency market. Also, with the upcoming halving event (expected in 2024), where the reward for mining new blocks is halved, historically this has led to an increase in Bitcoin's price.

In simpler terms, Bitcoin's journey into 2024 is expected to be marked by continued growth and increased acceptance. Its unique characteristics like limited supply and decentralized nature, coupled with wider institutional adoption, position it for potentially greater heights in the coming year

Ethereum Analysis

Ethereum, known as the world's programmable blockchain, has made significant strides in 2023. It's not just its price that's interesting, which saw an increase of nearly 50%, but also its vibrant and evolving ecosystem. Ethereum's primary attraction lies in its support for smart contracts and decentralized applications (dApps), making it a hub for blockchain innovation.

One of the most notable developments for Ethereum has been its transition to Ethereum 2.0, which involves moving from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. This change aims to make Ethereum more scalable, secure, and sustainable, addressing some of the main challenges the network has faced, such as high gas fees and network congestion.

Looking ahead to 2024, Ethereum is expected to further solidify its position as a leading platform for decentralized applications. Its continuous improvements and updates are likely to attract more developers and users, fostering a richer and more diverse ecosystem. The reduction in transaction costs and increased efficiency brought about by Ethereum 2.0 will likely boost its adoption in various sectors, including finance, gaming, and the emerging field of decentralized autonomous organizations (DAOs).

In simple terms, Ethereum's journey towards 2024 is marked by technological advancements and a growing ecosystem. Its role in the blockchain space is evolving beyond just a cryptocurrency to a foundational platform for decentralized applications and innovations

Solana Analysis

Solana has been a noteworthy player in the cryptocurrency market, distinguishing itself with its high throughput and low transaction costs. Known for its efficiency and speed, Solana offers a significant advantage for decentralized applications (dApps) and crypto projects requiring quick and cost-effective transactions. Its unique consensus mechanism, Proof of History (PoH), combined with Proof of Stake (PoS), allows for this increased efficiency.

In 2023, Solana has continued to gain traction, not only in terms of its market value but also in its adoption and usage in various blockchain applications. Its ability to support a wide range of applications, from DeFi to NFTs (Non-Fungible Tokens), makes it a strong contender among emerging cryptocurrencies.

Looking towards 2024, Solana is expected to further expand its ecosystem. As the blockchain industry continues to grow, platforms like Solana that offer scalability and speed are likely to see increased adoption. Its role in supporting new and innovative blockchain applications could be a significant factor in its growth and popularity.

In simpler terms, Solana's path to 2024 is shaped by its technical strengths and growing ecosystem. Its ability to handle high transaction volumes at low costs positions it well in the competitive landscape of cryptocurrencies, especially as the demand for scalable and efficient blockchain solutions continues to rise

Cryptocurrency Trends 2024

As we inch closer to 2024, leading industry analysts predict significant changes and transformative evolutions in the cryptocurrency landscape. The nascent but rapidly maturing digital asset class of cryptocurrencies remains at the forefront of innovative financial technologies, fueled by advancements in blockchain technology. Identifying and understanding cryptocurrency trends in 2024 will be essential for both seasoned investors and novices in this highly disruptive marketplace.

Several factors will influence cryptocurrency trends in 2024. These include regulatory changes, technological advancements, shifts in market dynamics, and changes in user sentiment and behavior. For instance, decentralized finance (DeFi) and the emergence of Web3 developments appear to be shaping the trajectory for many cryptocurrencies, bringing along with them a new array of opportunities and challenges. This indicates a more inclusive financial ecosystem, thus redefining cryptocurrency trends in 2024.

The DeFi Landscape: What Lies Ahead in 2024

The DeFi, or Decentralized Finance, space is poised for significant evolution in the near future. As we head towards 2024, the Cryptocurrency trends suggest a marked increase in DeFi applications and their adoption. DeFi already offers a myriad of platforms for investment, lending, trading, and other financial interactions which are anticipated to become even more sophisticated and user-friendly.

In the budding context of Cryptocurrency trends 2024, an accelerated move towards a more decentralized economy is expected. Numerous traditional financial services are beginning to extend their operations into the DeFi space, cognizant of its disruptive potential. Predictions suggest that profound regulatory changes and technological advancements such as Layer 2 solutions will drive the DeFi market forward, unlocking further potential in the digital economy. However, with such rapid growth, the need for regulatory compliance and security measures will continue to be of utmost importance.

Web3 Developments: The Next Step in Internet Evolution

As we approach 2024 swiftly, the importance of Web3 developments in re-modeling the internet landscape cannot be overstated. The integration of these developments not only represents a leap in the way we interact with the internet but also how we handle our financial transactions. Brave new innovations within the Blockchain space are unfolding, including Decentralized Finance (DeFi), non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs). These are perceived as the harbingers of a fundamentally different approach to value exchange, contributing to the growth of new cryptocurrency trends.

However, the rise of Web3 is not merely a catalyst for cryptocurrency trends, but it ushers in a new wave of digital evolution. This new wave is expected to shift focus from a data-driven and centralized internet (Web2) to a decentralized, user-centric one (Web3). In this context, cryptocurrency trends 2024 will be crucial for understanding projected shifts in digital asset ownership, data rights, and the increasingly significant role of blockchain technologies. The development of Web3 is essentially shaping up to be the technological revolution of our time.

Emerging Regulatory Changes in the Cryptocurrency Sector

As the digital finance industry matures, governmental bodies worldwide are tasked with developing appropriate cryptocurrency regulations. It is anticipated that 2024 will witness significant regulatory changes in the cryptocurrency sector, reflecting the relative promises and risks associated with this rapidly evolving space. Additionally, keeping under purview the increasing global adoption of cryptocurrencies, one can expect intensifying debates around consumer protection, financial stability, and national security.

In response to these anticipated changes, stakeholders in the crypto markets are projected to adapt their strategies to comply with new rules and increased oversight. Projected cryptocurrency trends for 2024 suggest that investors, too, will need to recalibrate their investment strategies in line with regulatory changes to avoid potential legal pitfalls. Given the cross-border nature of cryptocurrencies, international cooperation is expected to intensify in 2024, ensuring the uniformity of regulations across jurisdictions.

Investor's Guide: Crypto Opportunities to Watch for in 2024

As we inch closer to the year 2024, the financial landscape continually evolves, driven by ground-breaking developments in technology and digital currencies. One of the most significant trends that experts predict is the persistent growth of the cryptocurrency market. Cryptocurrency trends in 2024, including Bitcoin and Ethereum, are projected to experience substantial upward trajectories. However, as an investor, one must exercise prudence, given the sector's inherent volatility.

Bitcoin, despite its occasional fluctuations, is projected to maintain its dominance in the crypto universe. Meanwhile, Ethereum's shift to Ethereum 2.0 is anticipated to streamline DeFi services, illustrating yet another promising aspect of cryptocurrency trends in 2024. Other rising stars in the crypto market, such as Chainlink and Polkadot, also pose significant investment opportunities. On the other side, movements in regulatory access to these digital currencies, at least in some economies, may disrupt the bullish cryptocurrency trends in 2024.

Challenges and Opportunities in the Crypto Space by 2024

As we approach 2024, several challenges appear to be forming on the horizon for the cryptocurrency space. Among these are regulatory risks, security threats, and market volatility. Regulatory measures imposed by governments worldwide pose an imminent threat, as they often result in price swings and market instability. Similarly, security risks persist, with hackers and fraudsters continually evolving their methods to exploit vulnerabilities within crypto networks and exchanges. These challenges could significantly impact cryptocurrency trends in 2024 and present hurdles for both stakeholders and ordinary traders.

In spite of these emerging challenges, there's a silver lining that indicates just as many opportunities within the crypto space. First and foremost, the potential for high returns on investment continues to attract new market participants. Furthermore, the further development and acceptance of blockchain technology, the force behind cryptocurrencies, fuels optimism about the future of this sector. DeFi (Decentralized Finance) and Web3 developments, for instance, promise to revolutionize the way we conduct financial transactions and online interactions, respectively. These innovations could potentially drive cryptocurrency trends in 2024 and beyond, offering significant opportunities for those prepared to navigate the crypto-landscape effectively.

Future Developments in Decentralized Finance (DeFi)

Decentralized Finance (DeFi) has radically transformed the traditional financial system in recent years. The rise of DeFi is fueled by the innovative prospects it unveiled in the financial landscape through the use of blockchain technology. As we approach 2024, we anticipate a further consolidation of this revolutionary financial arrangement. The inherent capabilities of DeFi, such as transparency, security and inclusivity are likely to catalyze rapid advancements in the industry.

In line with the cryptocurrency trends of 2024, a parallel rise in DeFi platforms and applications is expected. This increase reflects the demographic shift of investors and users who are finding immense value in decentralized economies. The development of stablecoins, lending platforms, cryptocurrency-backed loans, and Decentralized Exchanges (DEXs) continue to shape the 2024 outlook of DeFi. As these technologies evolve, the import of DeFi in redefining financial practices becomes increasingly evident.

Regulatory Measures and Their Impact on Cryptocurrencies

As we approach 2024, the crux of cryptocurrencies' future undoubtedly hinges on the shape of regulatory measures implemented across various nations. It's undeniable that these regulations exert significant influence on cryptocurrency trends for 2024, affecting everything from market volatility to trader confidence. For instance, stringent regulatory measures could break the momentum of cryptocurrencies, leading to reduced investor interest. On the other hand, a supportive regulatory environment could foster growth by inviting diverse demographics to participate in digital asset trading.

What is noteworthy is that the nature of these regulatory measures will invariably shape the evolution of cryptocurrencies, potentially defining trends in 2024 and beyond. As financial authorities scramble to comprehend and control the rapidly transforming crypto landspace, their decisions could either cement the legitimacy of digital assets or reverse their mainstream adoption. Therefore, comprehending and predicting these regulatory measures is integral to understanding cryptocurrency trends for 2024. These regulations will not only steer the market dynamics, but also influence the strategies of crypto traders and investors.

How Web3 Developments Will Shape the Crypto World

Web3, the next phase in the evolution of the internet, is expected to create a significant impact on the crypto world as it propels the shift from traditional, centralized systems to decentralized alternatives. This shift will catalyze a new era of digitized interactions that would not only improvise traditional systems but also spawn a multitude of novel platforms, products, and services. With blockchain at its core, positioned as the substructure of Web3, the future certainly holds immeasurable potential for cryptocurrencies, and is expected to substantially influence Cryptocurrency trends 2024.

Driven by transparency, security, and authenticity, Web3 is certain to have a transformative influence on cryptocurrencies by facilitating a higher level of privacy, programmability, and scalability. Users get more control over their digital identities and transactions, thereby generating growing interest in decentralized finance solutions. This invariably opens up new horizons for the crypto cosmos, creating a plethora of opportunities for mainstream adoption and significantly molding Cryptocurrency trends 2024. As Web3 progresses, it is not a question of if, but when cryptocurrencies will become an essential part of our day-to-day transactions.

Frequently asked Questions

What are the key trends to expect in the cryptocurrency world in the coming years?

Cryptocurrency trends in the coming years could include increased adoption rates, improved regulatory clarity, and the greater integration of blockchain technology into various sectors. Web3 developments will also play an instrumental role in shaping the crypto world by enabling decentralized applications and smart contracts.

What are the expectations and forecasts for blockchain technology by 2024?

By 2024, blockchain technology is expected to be more mature with increased adoption in different industries. The technology is likely to be more efficient, secure, and scalable, enabling more advanced applications beyond cryptocurrencies.

What is the prospective outlook for Bitcoin in 2024?

The outlook for Bitcoin in 2024 is largely positive, with expectations of increased adoption, improved scalability, and greater regulatory clarity. However, the market is also likely to remain volatile and subject to macroeconomic factors.

What can we expect from Ethereum in the future?

Ethereum is expected to continue its evolution with the full implementation of Ethereum 2.0 by 2024. This upgrade will introduce sharding and staking, improving scalability and energy efficiency. It is also expected that Ethereum's position as the leading platform for DeFi and NFTs will be enhanced.

How could the DeFi landscape change by 2024?

The DeFi landscape in 2024 is likely to be more mature and integrated into the traditional financial system. We can expect more regulated DeFi products, improved security measures, and more widespread usage.

How will Web3 developments shape the crypto world?

Web3 developments will shift the internet from a centralized to a decentralized structure, transforming how users interact online. This could lead to increased privacy, greater control over personal data, and the rise of decentralized applications, which will significantly impact the crypto space.

What regulatory changes are emerging in the cryptocurrency sector?

Regulatory changes in the cryptocurrency sector are expected to bring more clarity and stability. Governments and financial entities worldwide are likely to implement regulations to ensure security, transparency, and consumer protection without stifling innovation.

What are the potential challenges and opportunities in the crypto space by 2024?

Challenges in the crypto space by 2024 may include regulatory hurdles, security issues, and scalability concerns. Opportunities could include increased institutional investment, technological advancements like Web3, and greater acceptance of cryptocurrencies as a legitimate form of payment.

What future developments can we expect in Decentralized Finance (DeFi)?

Future developments in DeFi could include the introduction of more complex financial products, increased interoperability between different DeFi platforms, and improved security protocols.

How will regulatory measures impact cryptocurrencies?

Regulatory measures will likely bring more legitimacy to cryptocurrencies, making them more attractive to institutional investors. However, they may also impose certain restrictions and requirements that could impact the decentralized nature of cryptocurrencies.

Pingback: Crypto Bubbles: The Rise and Fall of Cryptocurrency Mystery Solved - techlooters.com